Since 1980, the whole value of four-year private and non-private faculties has practically tripled. Student loan debt has ballooned to over $1.6 trillion for greater than 45 million debtors. One-third of debtors by no means attain a level, and those that graduate accomplish that with near $25,000 in debt.

In order to assist working and middle-class American debtors the Biden administration in August introduced a three-part plan to forgive a portion of student loans for debtors. Part of his plan and marketing campaign promise was to forgive $10,000 in student debt for tens of tens of millions of debtors. He upped the reduction to $20,000 for debtors who obtained a Pell Grant in faculty.

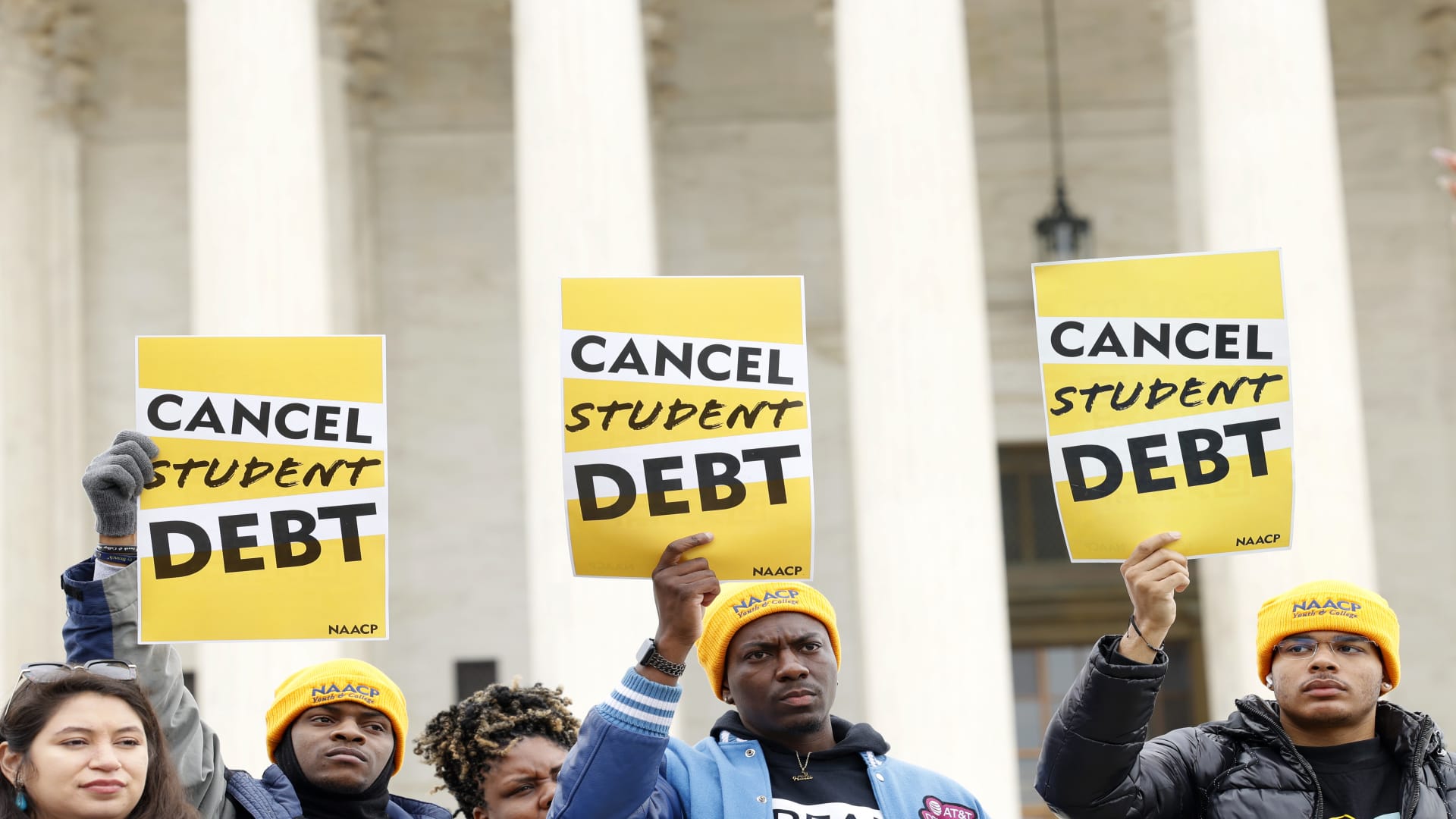

Biden’s plan was met with authorized opposition and criticism.

“At this level in our financial system, we actually do not should be including $500 billion of deficit spending for a function that frankly consists of rich legislation college students and enterprise faculty graduates getting tens of hundreds of {dollars},” mentioned Jason Furman, Harvard economics professor and former chair of the Council of Economic Advisers, throughout an interview with CNBC in August.

In October, courts blocked the continuation of the plan as a result of lawsuits from Republicans, states and people.

The Supreme Court agreed to listen to two of these authorized challenges: One introduced by six GOP-led states that argue that forgiveness will harm the corporations of their states that service federal student loans, and one other involving two plaintiffs who say they have been harmed by the coverage by the indisputable fact that they’re partially or absolutely excluded from the loan forgiveness.

Biden’s attorneys denied the declare that the Biden administration was overstepping its authority, laying out the White House’s argument that it’s performing inside the legislation. It factors to the indisputable fact that the Heroes Act of 2003 grants the U.S. secretary of schooling the authority to waive laws associated to student loans throughout nationwide emergencies.

Federal student loan funds will not resume till the finish of August, except the litigation over the Biden administration’s student loan forgiveness plan is resolved sooner.

Watch the video above to seek out out extra about what’s at stake in the student loan forgiveness battle.