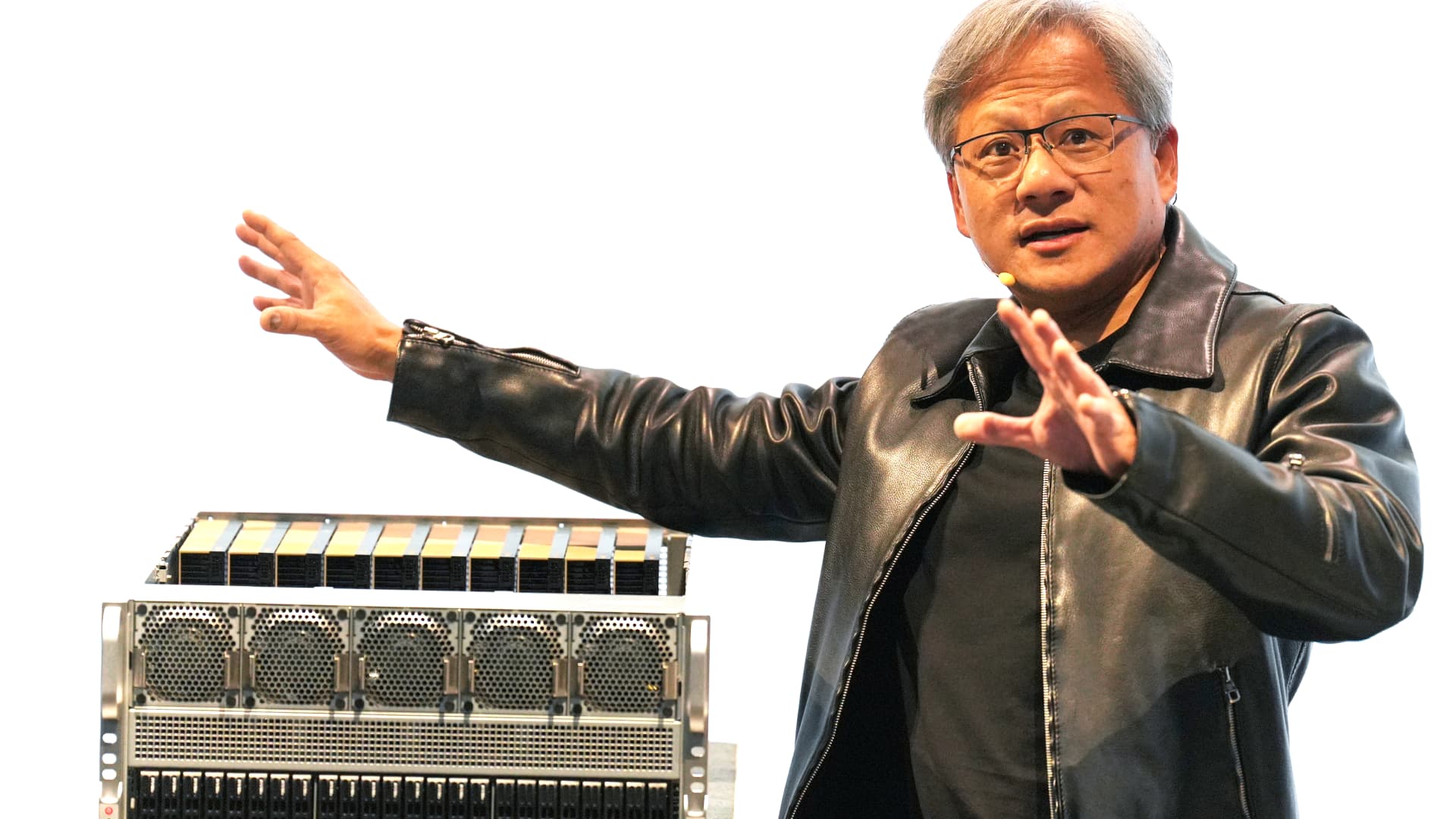

Nvidia CEO Jensen Huang,speaks on the Supermicro keynote presentation in the course of the Computex convention in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Images | Lightrocket | Getty Images

Here’s our Club Mailbag e-mail investingclubmailbag@cnbc.com — so that you ship your questions instantly to Jim Cramer and his crew of analysts. We cannot provide private investing recommendation. We will solely contemplate more normal questions in regards to the funding course of or shares within the portfolio or associated industries.

This week’s query: The cardinal rule of self-discipline is to not violate cost basis and present endurance to buy more high-quality shares on pullback. How do you consider a flying inventory which could not come again to ranges of cost basis to add more? Recent examples embrace Nvidia (NVDA), Eli Lilly (LLY) and Tesla (TSLA). — Thanks, Ravi