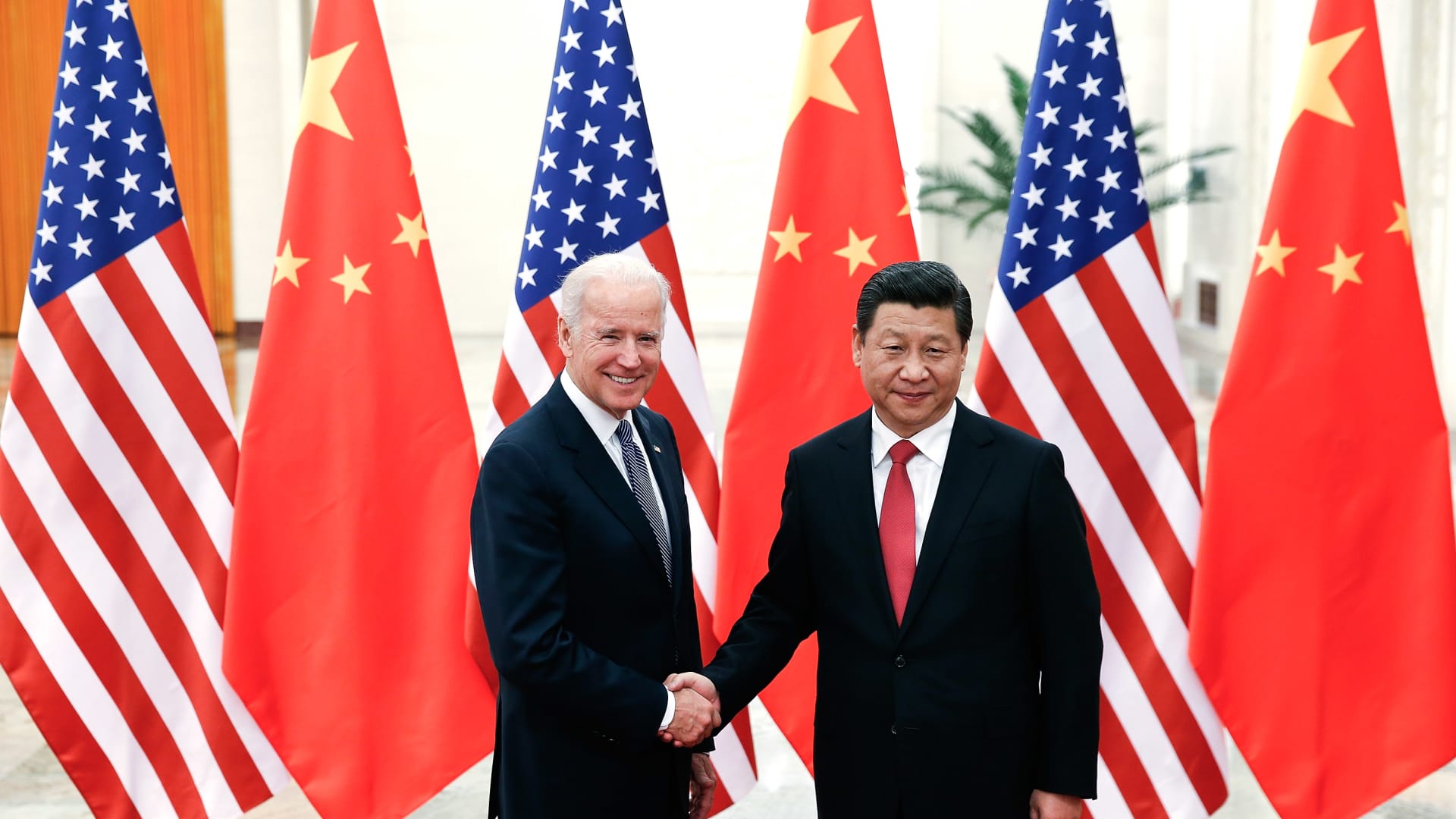

Chinese President Xi Jinping and arms with then U.S Vice President Joe Biden contained in the Great Hall of the People on December 4, 2013 in Beijing, China.

Lintao Zhang | Getty Images News | Getty Images

Leaders of the Group of Seven agreed there is a want to de-risk, not decouple from China, and acknowledged challenges posed by the mainland’s practices which “distort the worldwide financial system.”

“We are not decoupling or turning inwards,” the G-7 stated in a joint assertion launched over the weekend as leaders met in Hiroshima, Japan. “At the identical time, we acknowledge that financial resilience requires de-risking and diversifying.”

Leaders added, “We will search to deal with the challenges posed by China’s non-market insurance policies and practices, which distort the worldwide financial system. We will counter malign practices, akin to illegitimate know-how switch or knowledge disclosure.”

Reiterating the stance, President Joe Biden stated at a press convention on Sunday: “We’re not wanting to decouple from China, we’re wanting to de-risk and diversify our relationship with China.

He defined meaning taking steps to diversify provide chains, “so we’re not dependent on anyone nation for essential product. It means resisting financial coercion collectively and countering dangerous practices that harm our staff. It means defending a slim set of superior applied sciences essential for our nationwide safety.”

Speaking after the G-7 finance ministers and central financial institution governors’ assembly earlier this month, U.S. Treasury Secretary Janet Yellen stated China’s habits is “a matter that needs to be of concern to all of us.”

“There have been examples of China utilizing financial coercion on international locations that take actions that China’s not pleased with from a geopolitical perspective,” she stated, citing China’s commerce disputes with Australia and Lithuania as examples.

In their assertion the G-7 leaders stated, “We will foster resilience to financial coercion. We additionally acknowledge the need of defending sure superior applied sciences that could possibly be used to threaten our nationwide safety with out unduly limiting commerce and funding.”

The world’s main democracies stated the group will “cut back extreme dependencies in our essential provide chains” whereas emphasizing the necessity to cooperate with China, citing its function within the worldwide group and the dimensions of its financial system.

“We stand ready to construct constructive and secure relations with China, recognizing the significance of partaking candidly with and expressing our issues instantly to China. We act in our nationwide curiosity,” the assertion stated.

President Joe Biden’s administration beforehand briefed trade teams such because the Chamber of Commerce on measures looking for to curb American investments into China, in accordance to media stories.

Such guidelines would imply stricter pointers for U.S. firms that might be required to inform the federal government of recent investments in Chinese know-how firms, according to Politico. Deals in essential sectors akin to microchips will even be banned, in accordance to the publication.

U.Ok. Prime Minister Rishi Sunak additionally informed journalists that London was open to following the U.S. lead over curbs on Chinese funding, the Financial Times reported.

Decoupling dangers forward?

Ahead of the weekend’s G-7 summit, Goldman Sachs economists Hui Shan and Andrew Tilton stated they anticipated steps to be taken by the Committee on Foreign Investment within the United States, or CFIUS — a U.S. authorities company that evaluations offers involving international funding within the U.S. to see if the transaction infringe on the nation’s nationwide safety.

In a be aware previewing the set of measures earlier this month, they stated there could also be “extra focus on refining the prevailing tariff, export management, and funding regimes as soon as fundamental frameworks are in place.”

“We anticipate them to be pretty narrowly-focused on superior semiconductors and associated applied sciences, paralleling final autumn’s export controls, and do not anticipate important restrictions on secondary market portfolio investments.”

‘Far-reaching’ damages

The impression of a widening rift between the U.S. and China might lead to additional harm, economists at Allianz stated in a be aware las Wednesday.

“The financial implications of an extra decoupling between the West and China could possibly be far-reaching,” they wrote, including the harm to the Chinese financial system could possibly be “far from negligible.”

“China might retaliate by curbing the provision of essential uncooked supplies during which it has a dominant place, which might severely disrupt international provide chains,” they stated.

“But that is unlikely because it already applies some types of outbound funding restrictions and continues to be wanting in direction of financial pragmatism.”

The Taiwan issue

Further escalations might doubtlessly lie forward for U.S.-China relations after Washington concluded negotiations with Taiwan on a variety of commerce gadgets on Friday, marking a possible deal on the primary a part of the bilateral “21st Century Trade” initiative.

The first settlement underneath the initiative consists of: customs administration and commerce facilitation, good regulatory practices, companies home regulation, anticorruption, and small and medium-sized enterprises, the office of the United States Trade Representative said in a release.

U.S. commerce consultant Katherine Tai stated of the settlement, “This accomplishment represents an necessary step ahead in strengthening the U.S.-Taiwan financial relationship.”

China has repeatedly warned in opposition to deepening bilateral engagement between the U.S. and Taiwan.

Goldman Sachs argued that with the Taiwan issue, the main focus of U.S.-China tensions might shift from commerce to navy.

“The extra speedy focus has been on constructing Taiwan’s navy capabilities to deter a battle,” U.S. political economists Alec Phillips and Tim Krupa wrote earlier this month, including that they see “good odds” that the U.S. Congress passes further assist to at the moment current schemes.