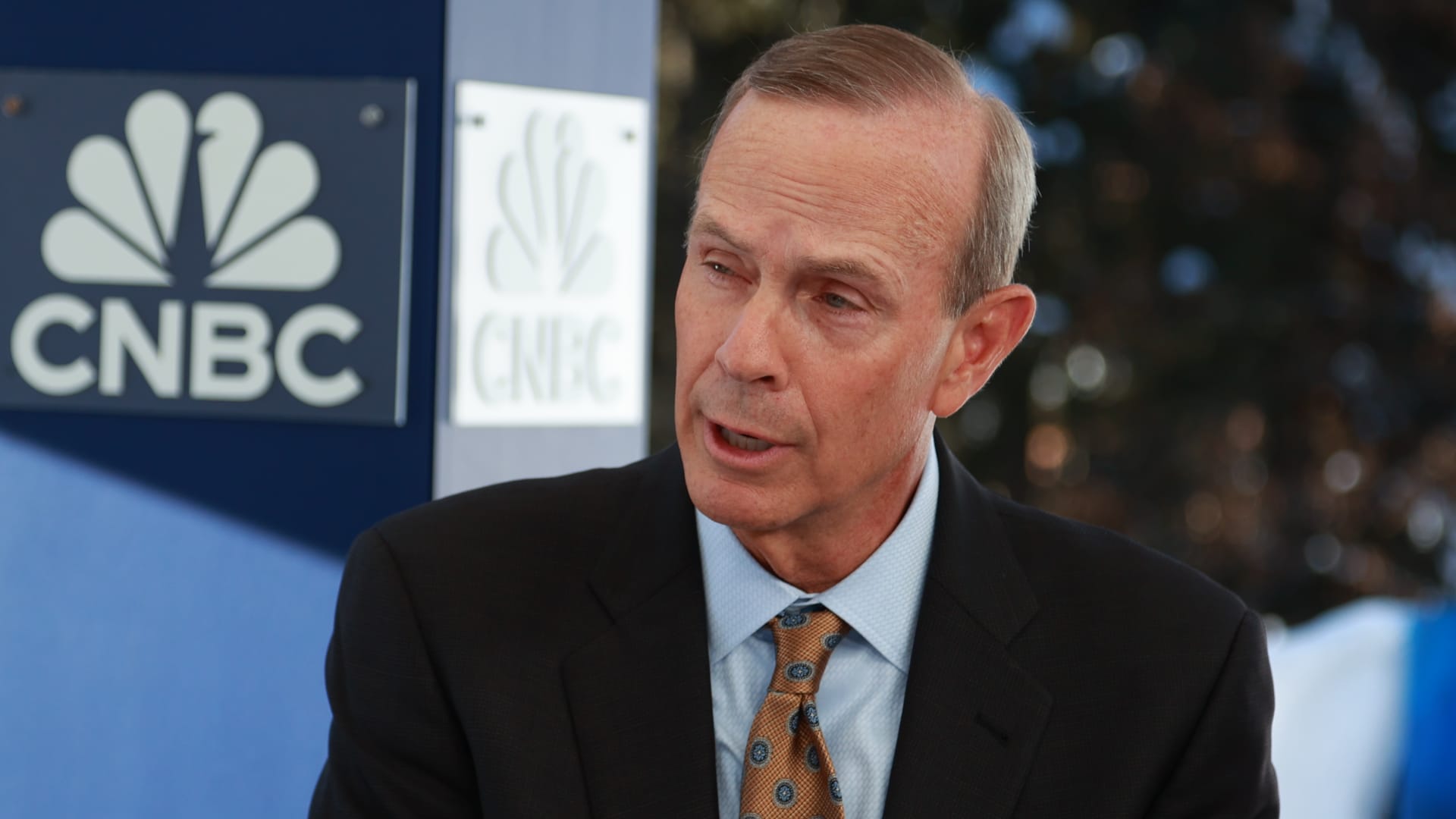

The disaster within the Red Sea poses critical dangers to oil flows and prices could change shortly if tensions lead to a serious supply disruption within the Middle East, Chevron CEO Michael Wirth informed CNBC on Tuesday.

“It’s a really critical scenario and appears to be getting worse,” Wirth mentioned in an interview on the World Economic Forum in Davos, Switzerland.

The Chevron CEO mentioned he was stunned that U.S. crude oil was trading below $73 a barrel as a result of the “dangers are very actual.”

“So a lot of the world’s oil flows via that area that have been it to be minimize off, I feel you could see issues change very rapidly,” Wirth mentioned.

Chevron has continued transporting crude via the area as the corporate works carefully with the U.S. Navy’s Fifth Fleet, Wirth mentioned. The CEO cautioned that scenario is evolving.

“We actually have to watch very rigorously,” Wirth informed CNBC.

Shell suspends Red Sea shipments

The British oil main Shell has suspended shipments via the Red Sea, folks aware of the matter informed The Wall Street Journal Tuesday. Shell declined to remark in response to a request from CNBC.

Shell’s resolution to halt shipments via the essential commerce chokepoint comes a few month after BP paused transits via the Red Sea. Several main tanker companies, which transport petroleum merchandise equivalent to gasoline in addition to crude oil, halted site visitors towards the Red Sea on Friday.

Houthi militants, who’re based mostly in Yemen and allied with Iran, have repeatedly attacked business vessels within the Red Sea in response to Israel’s warfare in Gaza. The U.S. and Britain have launched airstrikes towards Houthi targets in Yemen to safe transport via the waterway.

The Houthis have continued to launch assaults regardless of the U.S.-led strikes. The militants on Tuesday launched an antiship ballistic missile that struck a Maltese-flagged bulk service within the Red Sea, in accordance to U.S. Central Command. No accidents have been reported and the vessel continued to transit the waterway, in accordance to CENTCOM.

Sullivan: Houthis are hijacking the world

U.S. National Security Advisor Jake Sullivan mentioned nations with affect in Iran want to take a stronger stand to display the “total world rejects wholesale the concept a bunch just like the Houthis can mainly hijack the world as they’re doing.”

The U.N. Security Council adopted a decision final week condemning the Houthi assaults “within the strongest potential phrases.” Permanent council members China and Russia, which wield veto energy, abstained from the vote on the decision.

“We anticipated that the Houthis would proceed to attempt to maintain this vital artery at risk, and we proceed to reserve the correct to take additional motion, however this wants to be an all palms on deck effort,” Sullivan mentioned throughout an interview in Davos on Tuesday.

Oil market and geopolitical analysts say that the most important risk to power provides would come if Middle East tensions erupt right into a regional battle that disrupts crude oil flows out of the Strait of Hormuz.

Some 7 million barrels of crude oil and merchandise transit the Red Sea each day, in contrast to 18 million barrels that transit the Strait of Hormuz, in accordance to knowledge from the commerce analytics agency Kpler.

Goldman Sachs has warned {that a} extended disruption within the Strait of Hormuz could double oil prices, although the funding financial institution views that state of affairs as unlikely.

Wirth mentioned Chevron had two ships attacked by the Iranian Navy final 12 months, one in all which was hijacked by commandos and brought to an Iranian port and the opposite took hearth for 4 hours till the U.S. Navy intervened.

Iran seized an oil tanker final week within the Gulf of Oman. The Marshall Islands-flagged tanker St. Nikolas was beforehand concerned in a dispute between the U.S. and Iran over sanctioned crude.