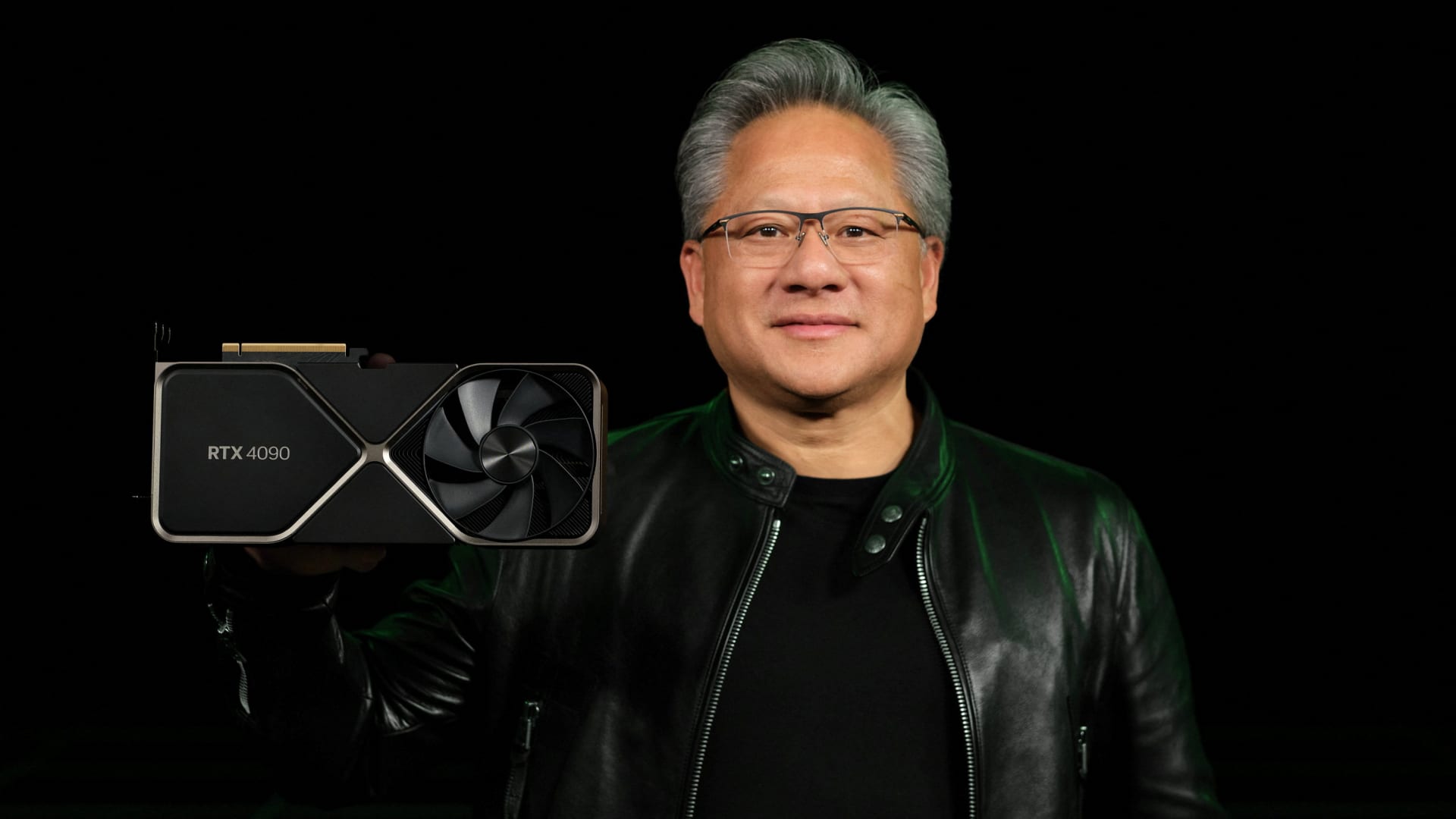

Nvidia Corp CEO Jensen Huang holds one of many firm’s new RTX 4090 chips for laptop gaming on this undated handout photograph offered September 20, 2022.

Nvidia Corp | by way of Reuters

AMD and Nvidia hit all-time highs on Thursday as buyers proceed to clamor for shares of the businesses constructing chips that energy synthetic intelligence.

AMD shares rose over 1% throughout buying and selling on Thursday to achieve its highest-ever closing value, $162.67, whereas Nvidia, rose slightly below 2% to $571.07. Both firms have notched double-digit share beneficial properties to begin the 12 months after an explosive 2023 by which AMD shares popped 127.6% and Nvidia inventory rocketed 238.8%.

The record valuations mirror continued investor curiosity and starvation for firms that design and promote graphics processors for synthetic intelligence. GPUs have been initially designed to play laptop video games,. But they’re additionally important for coaching and deploying intricate AI fashions like OpenAI’s GPT, main to an enormous surge in gross sales for the chips.

Nvidia has been the first GPU provider to AI firms for the previous two years and was the best-performing inventory within the S&P 500 final 12 months.

Investors are more and more bullish on AMD, the second-largest standalone GPU maker. the corporate introduced final 12 months a brand new chip that might compete with Nvidia’s H100, which is presently the usual for AI functions.

Analysts additionally see AMD bettering its AI software program, eliminating one main cause why Nvidia chips have been most well-liked over AMD’s.

On Thursday, Taiwan Semiconductor Manufacturing Company, which manufactures Nvidia and AMD chips, reported better-than-expected gross sales. CEO C.C. Wei stated that there was sturdy demand for AI chips, which use probably the most superior manufacturing methods.

TSMC administration believes manufacturing AI chips may signify a “high-teens” share of its income in 5 years, which has optimistic implications for each Nvidia and AMD, Goldman Sachs analysts led by Toshiya Hari wrote in a observe on Thursday.

Separately, Meta CEO Mark Zuckerberg, one of many largest patrons of GPUs, introduced plans on Thursday to buy billions of dollars worth of Nvidia and different GPUs this 12 months.