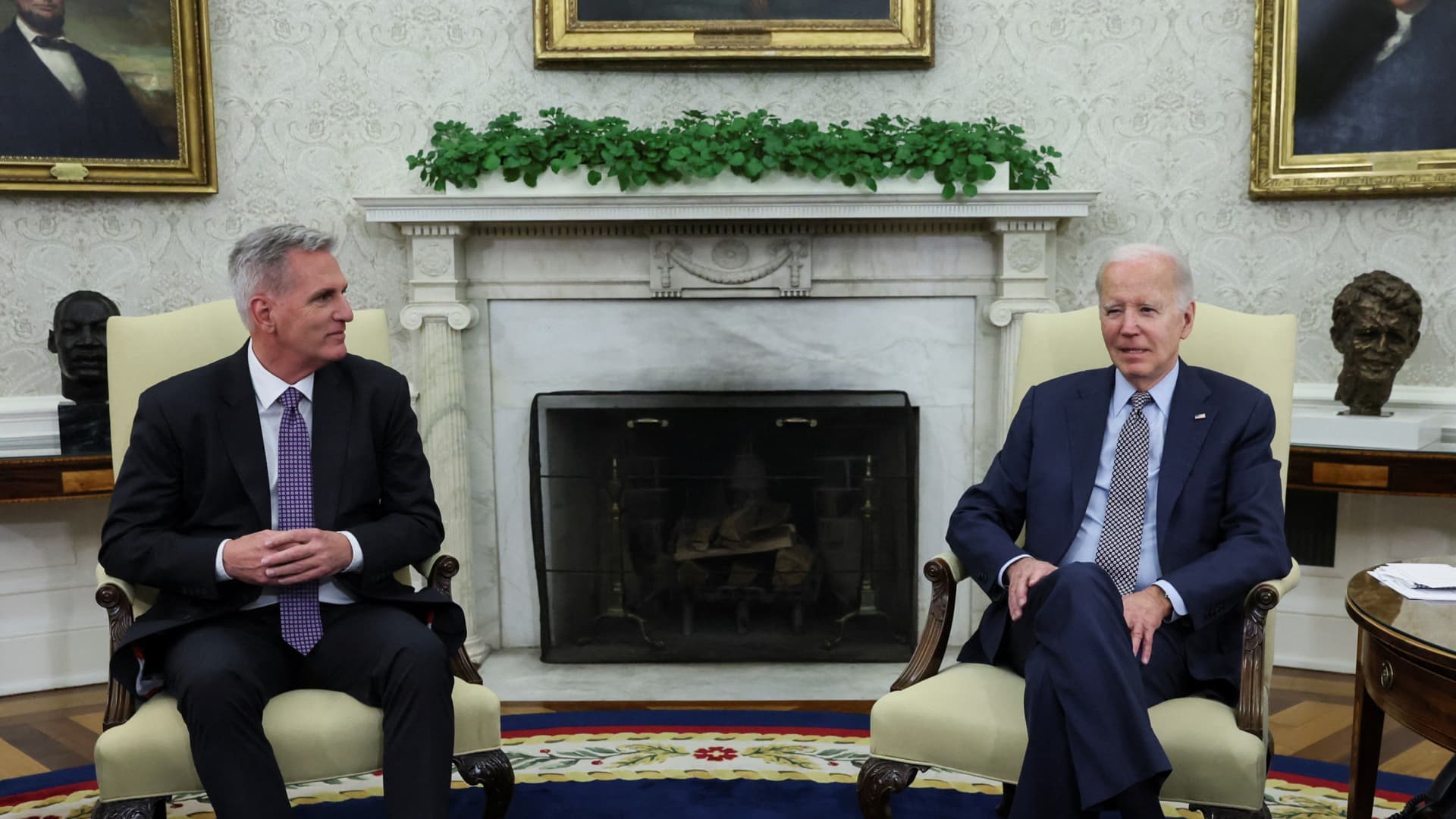

U.S. President Joe Biden hosts debt restrict talks with U.S. House Speaker Kevin McCarthy (R-CA) in the Oval Office at the White House in Washington, U.S., May 22, 2023. REUTERS/Leah Millis

Leah Millis | Reuters

A standoff between the White House and Congressional Republicans over elevating the U.S. debt ceiling has pushed the world’s largest economic system to the brink of defaulting on its payments.

This is just not the first time the previously procedural mechanism has triggered turmoil in Washington. Yet in Denmark — the only different democracy with a related kind of nominal debt ceiling — barely anyone is aware of it exists.

President Joe Biden and Republican House Speaker Kevin McCarthy held what the latter referred to as a “productive” assembly at the White House on Monday, however a deal stays elusive.

The Republican-led House needs sweeping cuts to federal discretionary spending, new work necessities for welfare recipients and an enlargement of mining and fossil gas manufacturing. The White House has to this point resisted.

The U.S. will default on its payments for the first time ever, if Democrats and Republicans are unable to interrupt the deadlock by June 1. This would likely have serious economic ramifications, together with a recession, mass federal job losses and a international inventory market collapse.

The debt ceiling has been in impact since 1917 and allows Congress to restrict the sum of money the federal authorities is ready to borrow to cowl its payments, making up the deficit between what it collects in taxes and spends on authorities actions already authorised by Congress.

It has been lifted 78 instances since 1960, final rising by $2.5 trillion in December 2021 to $31.381 trillion.

Once routine, discussions over elevating the debt ceiling have more and more turn into a platform for political brinkmanship — notably since 2011, when Republicans additionally threatened a default if the Obama administration didn’t grant spending cuts.

The episode prompted S&P Global to subject a first-ever downgrade to the U.S. credit standing, whereas Senate Minority Leader Mitch McConnell mentioned at the time that the debt ceiling — and by implication the U.S. economic system — was a “hostage price ransoming.”

The restrict was raised unconditionally by the Democratic-led House thrice underneath former Republican President Donald Trump’s administration, however historical past is now repeating itself.

Separation of church and state

While the U.S. debt ceiling restricts authorities borrowing to a explicit determine, most different economies set debt limits as a proportion of GDP.

For occasion, international locations which are a part of the European Union, underneath guidelines set out in the Maastricht Treaty, pledge to maintain their public debt beneath 60% of GDP and to keep up an annual finances deficit of lower than 3%.

Denmark is the only different democratic nation in the world with a debt restrict set at a mounted nominal determine, but it by no means produces the similar political and financial turmoil. In reality, it’s scarcely even talked about.

This is basically as a result of the Danish debt ceiling was designed to be a artificial constitutional provision and was set so excessive that it might by no means turn into the “political bargaining chip” it has in the U.S., as authorities borrowing wants repeatedly run up in opposition to it, in accordance with Laura Sunder-Plassmann, affiliate professor of economics at the University of Copenhagen.

Sunder-Plassmann additionally defined that Danish politics is much less politically polarized than the U.S., with two massive and a dozen or extra smaller however not insignificant events represented in parliament.

“While there are undoubtedly arguments to be made for fiscal guidelines, most superior international locations have opted for non-binding limits on debt to GDP ratios (and deficits) as an alternative of nominal quantities, which whereas maybe not good at the least avoids the form of debates we now see in the U.S.,” she mentioned through electronic mail.

The Danish debt ceiling, or “gældsloft,” was carried out as a constitutional requirement in 1993 after a restructure of the country’s authorities, and set at 950 billion Danish krone ($137.5 billion). Danish politicians contemplate it extra of a artificial formality, largely in place to reassure parliament and the public that the authorities of the day can’t go rogue.

COPENHAGEN, Denmark – Feb. 28, 2023: Members of the Danish Parliament attend a session earlier than a vote at the Folketing. Denmark is the only different country in the world with a debt ceiling akin to that of the U.S., nevertheless it by no means causes the similar political crises that Washington steadily faces.

LISELOTTE SABROE/Ritzau Scanpix/AFP through Getty Images

Denmark has traditionally retained a sturdy fiscal place, however suffered a vital deficit in the wake of the 2008 monetary disaster, prompting the debt ceiling to be elevated in 2010 to 2 trillion Danish krone.

This is a hefty restrict for a small country of round 6 million folks with a nationwide debt of simply 323 billion krone at the finish of 2022, in accordance with the Danish National Bank.

Denmark is operating a finances surplus and has seen its debt fall considerably over the previous decade. National debt to GDP declined steadily up till a spike in 2020 attributable to the Covid-19 pandemic and fell once more to simply over 30% of GDP by late 2022.

Jesper Rangvid, professor of finance at the Copenhagen Business School, informed CNBC on Tuesday that the Danish system is structured in order that political choices about fiscal coverage are confined to the public finances for tax and spending of every 12 months, with the debt ceiling a completely separate formality.

“It’s merely not mentioned on this country as a result of it is simply not a problem, and that’s, in fact, as a consequence of this issue that there was all of these surpluses for a few years on the authorities finances, and due to this fact debt has really been falling for a few years,” he defined through phone from Copenhagen.

“We have the political dialogue once we determine on expenditures and taxes and so forth, and the debt restrict shouldn’t be limiting that, which is in fact very completely different to the U.S., the place you each have the annual discussions on the finances, on expenditures and incomes, and since you continuously have deficits, then you definitely even have the discussions on the debt restrict.”

Rangvid added that, whereas Danish politicians throughout the country’s plethora of political events have a very broad spectrum of views on fiscal coverage, the key distinction is that the discussion board for discussing them is confined to the annual finances. Other capabilities of presidency due to this fact can’t be held hostage by the fiscal calls for of opposition events.