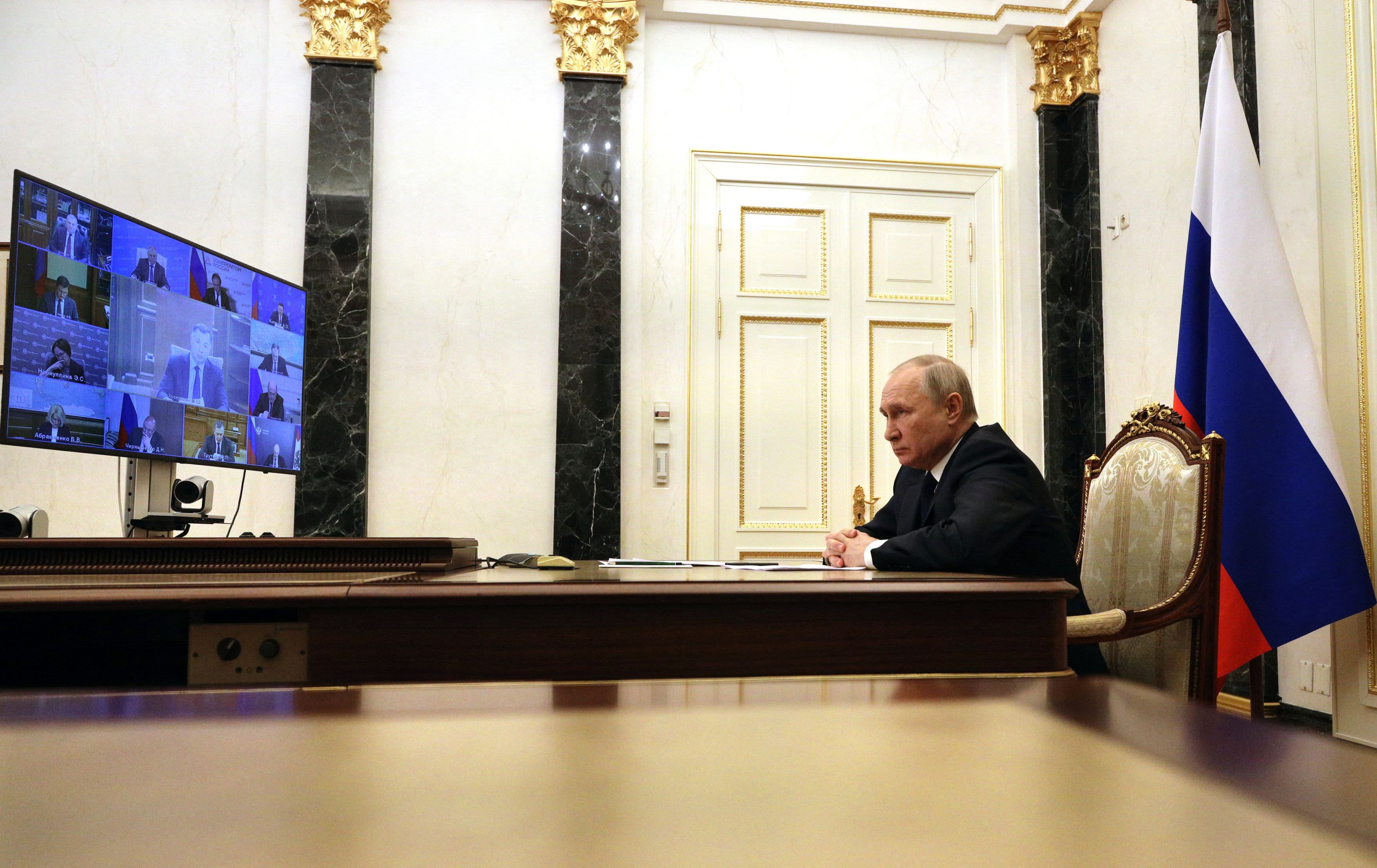

Russian President Vladimir Putin attends a gathering with authorities members through a video hyperlink in Moscow, Russia March 10, 2022.

Mikhail Klimentyev | Sputnik | Reuters

Russia could be about to default on its foreign currency debts for the primary time in many years, doubtless starting a drawn out wrangling course of with worldwide our bodies.

International sanctions on the Central Bank of Russia in response to the unprovoked invasion of Ukraine have blocked off a considerable portion of the nation’s international alternate reserves, which it could ordinarily use to service sovereign debt obligations.

Measures taken by Moscow to mitigate the impression — akin to capital controls — have led main rankings companies to downgrade Russia’s authorities debt, concluding {that a} debt default is now extremely doubtless.

This would mark Russia’s first sovereign default since 1998, when it defaulted on home debt, and the primary sovereign default on international forex debt because the Bolshevik Revolution in 1918.

Here’s a fast CNBC information to what’s going on:

When does it need to pay?

The Russian state is due to pay $117 million in curiosity on two sovereign eurobonds on Wednesday, the primary of 4 fee dates to collectors in March alone, however economists stay unsure as to precisely how Moscow will meet its debt obligations.

Russian Finance Minister Anton Siluanov indicated on Monday that Russia will use its reserves of Chinese yuan to make a few of its funds, with euros and dollars now inaccessible due to sanctions.

Alternatively, the federal government has warned that funds to collectors from “hostile” international locations will be made in rubles, with the forex having depreciated sharply because the invasion of Ukraine.

William Jackson, chief rising markets economist at Capital Economics, defined in a observe Monday that though some Russian FX bonds — these issued from 2018 — allow funds in rubles if they aren’t in a position to be made in different currencies, this doesn’t apply to Wednesday’s funds.

Jackson steered that trying to pay in rubles would subsequently be tantamount to a default, although topic to a 30-day grace interval earlier than it turned official.

Western governments even have an curiosity in Russia operating down its remaining accessible international forex property to pay collectors. This additional erodes free Russian FX property, according to Timothy Ash, senior emerging markets sovereign strategist at BlueBay Asset Management.

“At current the message appears to be that the Ministry of Finance is prepared and in a position to pay, however is being prevented from doing so by sanctions on the CBR, so the message from Russia is that if the West desires Western collectors to be paid, then sanctions on the CBR need to be freed/eased,” Ash famous in an electronic mail Monday.

“It has even issued a directive saying that it’s going to make fee in FX for debt service via international correspondent banks, but when these banks are unable to transact with the CBR due to sanctions, then monies owed will be paid in rubles however held on the National Security Depository (NSD) and fee then made in some unspecified time in the future sooner or later through so referred to as ‘S’ accounts.”

What are the implications?

This, Ash mentioned, would doubtless represent a default, however Russia’s finance ministry would then argue that it tried to pay however was prevented from finishing the transaction due to sanctions.

“While in a single respect the MOF would really like not to be in a position to pay their international collectors as this a) saves now scarce FX reserves; b) hurts buyers in adversary nations, they usually then hope these will foyer their very own governments for sanctions aid, the draw back is that non fee and potential default would have severe and future penalties for Russia,” Ash added.

A failure to pay would see Russian rankings reduce to default standing by the companies, which might be extended due to difficulties in guaranteeing fast debt restructuring. This would preserve Russian borrowing prices elevated and restrict financing choices, even from the likes of China, Ash steered.

“Even ought to the struggle finish shortly, and peace be resolved, markets and rankings companies will bear in mind this disaster for a while and rankings will be gradual to get better, and Russian borrowing prices gradual to reasonable. This will crimp Russian financial growth for years to come,” he added.

Come Wednesday, Ash projected that among the cash will doubtless have been paid, maybe with some delay, nevertheless it stays unclear whether or not international buyers will be in a position to entry it, and through which forex.

Russia and the score companies may also have to debate whether or not this constitutes a default, a dispute that he steered might find yourself within the courts.

Will it lead to extra defaults?

Capital Economics’ Jackson steered that whereas the default is essentially priced in for international buyers, and Russia’s sturdy public funds imply the federal government is just not vastly dependent on international financing, Russian company debt could come underneath risk.

“Perhaps the larger threat is that it could be a prelude to defaults by Russian corporates, whose exterior money owed are greater than 4 occasions bigger than these of the sovereign,” he mentioned.

“So far, Russian corporates appear to have continued servicing their money owed since sanctions had been tightened, however with commerce disrupted, sanctions doubtlessly being widened and the financial system set for a deep recession, the chance of company defaults is rising.”

BlackRock and Pimco have already been recognized among the many many world fund managers with publicity to Russian debt, although most of those positions have been marked down and are already mirrored within the fund costs.

Economists have broadly dismissed fears of a worldwide contagion impact if Russia defaults. IMF Managing Director Kristalina Georgieva mentioned in an interview on Sunday that world banks’ $120 billion publicity to Russia is “not systematically related.”

Jackson additionally famous that abroad collectors had largely marked down their holdings, whereas stating that the general dimension of Russian international forex sovereign debt held by non-residents is “comparatively small” at round $20 billion.