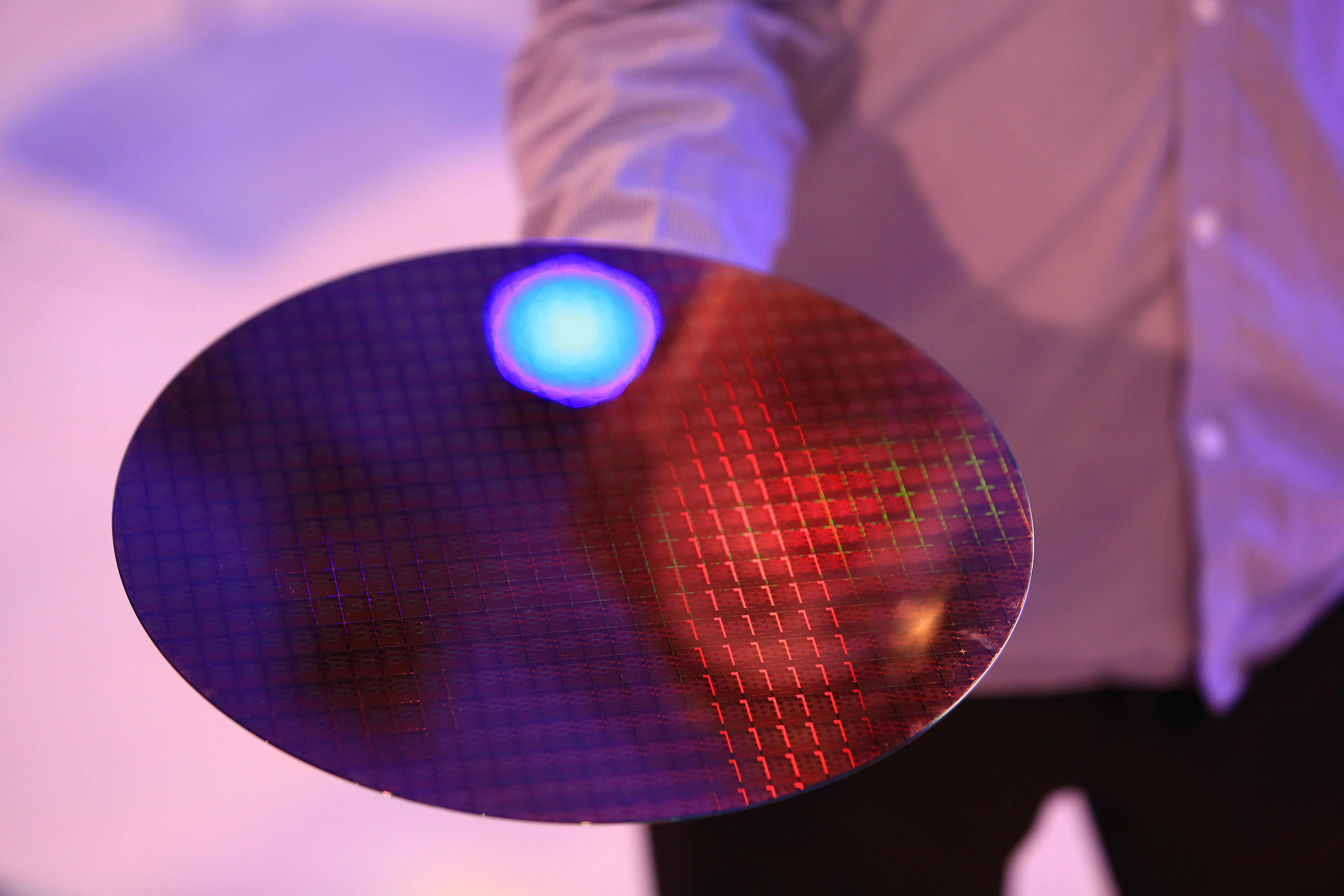

A semiconductor wafer throughout an Intel occasion forward of a IFA International Consumer Electronics Show.

Krisztian Bocsi | Bloomberg | Getty Images

InternationalWafers, a Taiwanese firm that makes silicon wafers for laptop chips, will not purchase Munich-headquartered rival Siltronic after policymakers in Germany did not approve the deal in time.

The deal’s collapse late on Monday night comes as nations look to bolster their “tech sovereignty” in order that they do not should be as reliant on different nations for important applied sciences like semiconductors. Europe is at present closely reliant on the U.S. and Asia, that are residence to corporations like Samsung, TSMC and Intel.

“The takeover supply by InternationalWafers and the agreements which got here into existence on account of the supply is not going to be accomplished and can lapse,” GlobalWafers said Tuesday.

Germany’s financial ministry didn’t clear the 4.35 billion euro ($4.9 billion) deal by the Jan. 31 deadline, that means the proposed acquisition cannot go forward as deliberate.

“It was not attainable to finish all the required assessment steps as a part of the funding assessment — this is applicable specifically to the assessment of the antitrust approval by the Chinese authorities, which was solely granted final week,” a spokesperson for Germany’s financial system ministry mentioned, based on Reuters.

The takeover, authorised by regulators in China on Jan. 21, would have created the second greatest maker of 300-millimeter wafers behind Japan’s Shin-Etsu.

InternationalWafers will now should pay a termination price of fifty million euros to Siltronic.

Wafers are a key constructing block within the chips which can be used to energy all the things from iPhones to automobile parking sensors.

Germany, which is residence to Infineon and numerous different chipmakers, has grown more and more cautious in regards to the semiconductor international provide chain after a worldwide chip scarcity harm its well-known automobile business.

The ministry mentioned an funding assessment could be carried out once more if InternationalWafers selected to make a brand new acquisition try.

Doris Hsu, the CEO of InternationalWafers, mentioned the end result was “very disappointing,” including that the firm will “analyze the non-decision of the German authorities and think about its impression on our future funding technique.”

In a press release, the corporate mentioned: “Europe stays an essential marketplace for InternationalWafers and it stays dedicated to the shoppers and staff within the area.”

Shares of Siltronic had been up over 2% in morning commerce on the Frankfurt Stock Exchange on Tuesday.

Elsewhere, numerous different chip offers are additionally being probed by governments and regulators. The most notable of which is Nvidia’s $40 billion bid for U.Okay. chip designer Arm, which is at present owned by Japan’s SoftBank.

Critics are involved that the merger with Nvidia — which designs its personal chips — may prohibit entry to Arm’s “impartial” semiconductor designs and will result in increased costs, much less selection and lowered innovation within the business. But Nvidia argues that the deal will result in extra innovation and that Arm will profit from elevated funding.