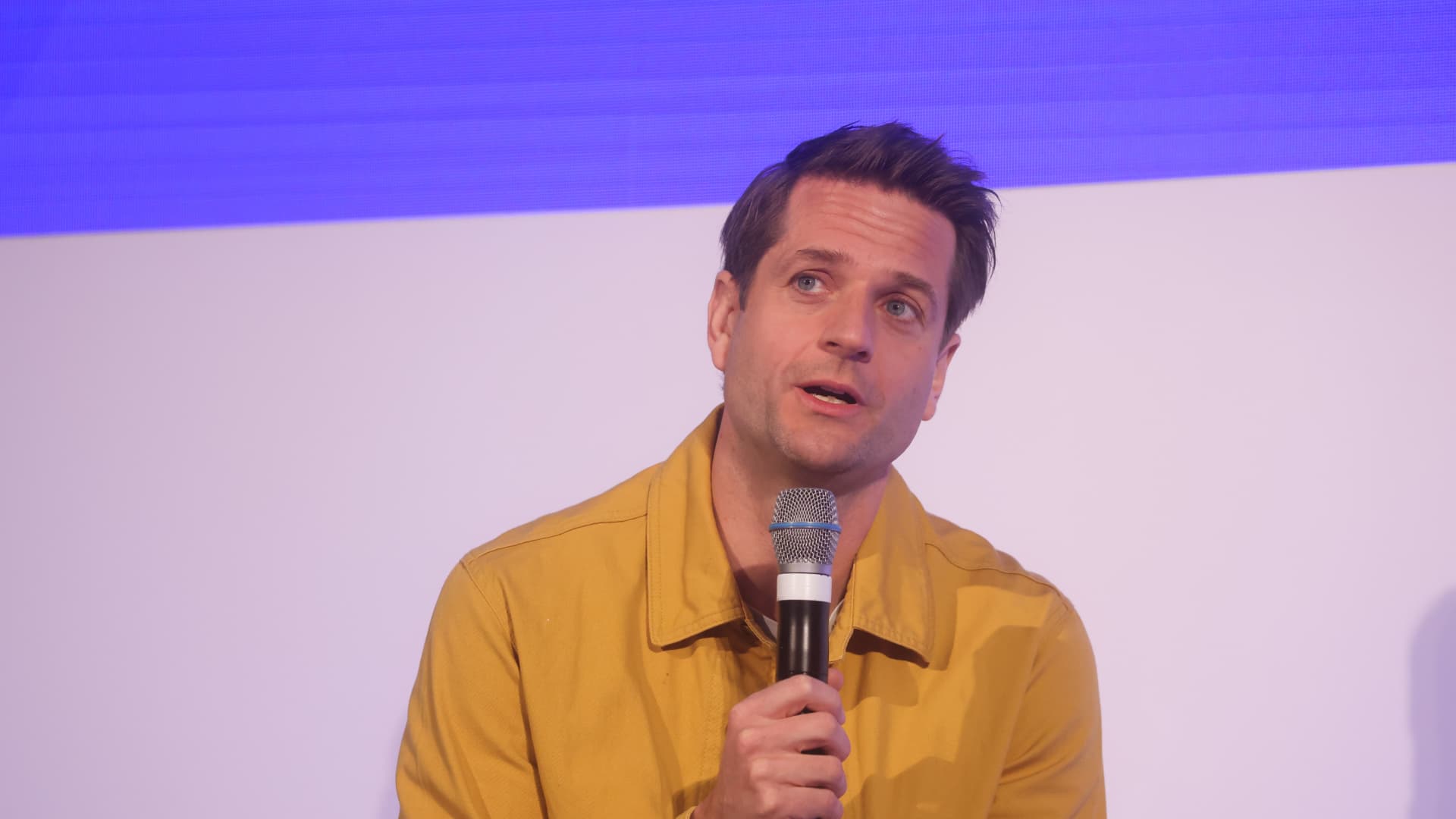

Sebastian Siemiatkowski, CEO of Klarna, talking at a fintech occasion in London on Monday, April 4, 2022.

Chris Ratcliffe | Bloomberg by way of Getty Images

Klarna, the Swedish purchase now, pay later fintech firm, halved its net loss in the first quarter, recording a big enchancment in its backside line after a significant cost-cutting drive.

The firm posted a net loss of 1.3 billion Swedish krona ($120.7 million), down 50% from the two.6 billion krona loss in the identical interval a yr in the past.

Klarna reported complete net working earnings of 5 billion Swedish krona, up 22% year-over-year.

“This quarter we have impressively managed to develop GMV and income, on the identical time as we lower prices and credit score losses, and in addition investing ambitiously in AI pushed merchandise,” Klarna CEO Sebastian Siemiatkowski stated in an announcement.

“We are on monitor to attain profitability this yr all whereas revolutionizing buying and funds via our AI-powered method.”

Siemiatkowski previously told CNBC the corporate was planning to attain profitability in the second half of 2023.

Klarna attributed the most recent discount in losses to a fall in buyer defaults due to an enchancment in its underwriting, as effectively as to diversification into different sources of income, such as advertising and marketing.

The outcomes present how Klarna is making “vital strides” toward profitability on a month-to-month foundation, the firm stated.

Klarna, which now has greater than 150 million prospects, was in April given a credit standing of BBB/A-3 with a steady outlook by S&P Global. The scores company on the time stated this mirrored Klarna’s “capacity to defend its sturdy e-commerce place in its key markets, rebuild profitability,” and “keep a robust capital buffer.”

Early indications sign that Klarna’s deep cost-cutting measures are beginning to repay. The firm went on a hiring spree throughout 2020 and 2021 to capitalize on development triggered by the Covid-19 pandemic, and was compelled to scale back headcount by roughly 10% in May 2022 in response to investor strain to slim down operations. Despite this measure, it nonetheless later misplaced 85% of its market worth in a funding spherical final summer time.

Klarna shouldn’t be alone in its troubles. Buy now, pay later companies, which permit consumers to defer funds to a later date or pay over installments, have been significantly impacted by souring investor sentiment on expertise, amid a worsening macroeconomic atmosphere.

AI push

More not too long ago, Klarna has turned its focus toward AI. The firm revamped its app with a extra superior AI suggestion algorithm to assist its retailers goal prospects extra successfully.

Klarna beforehand launched the power to combine OpenAI’s ChatGPT into its service with a plugin that lets customers ask the favored AI chatbot for buying inspiration. The firm stated it was embedding AI in its enterprise to “enhance inner efficiencies and supply prospects with a good higher service and expertise,” for instance via real-time translations in buyer chat.

The firm has now additionally made a foray into facilitating short-term vacation leases. Earlier this month, Klarna introduced a partnership with Airbnb to let the net trip rental firm’s prospects e book holidays and pay down the associated fee over installments.