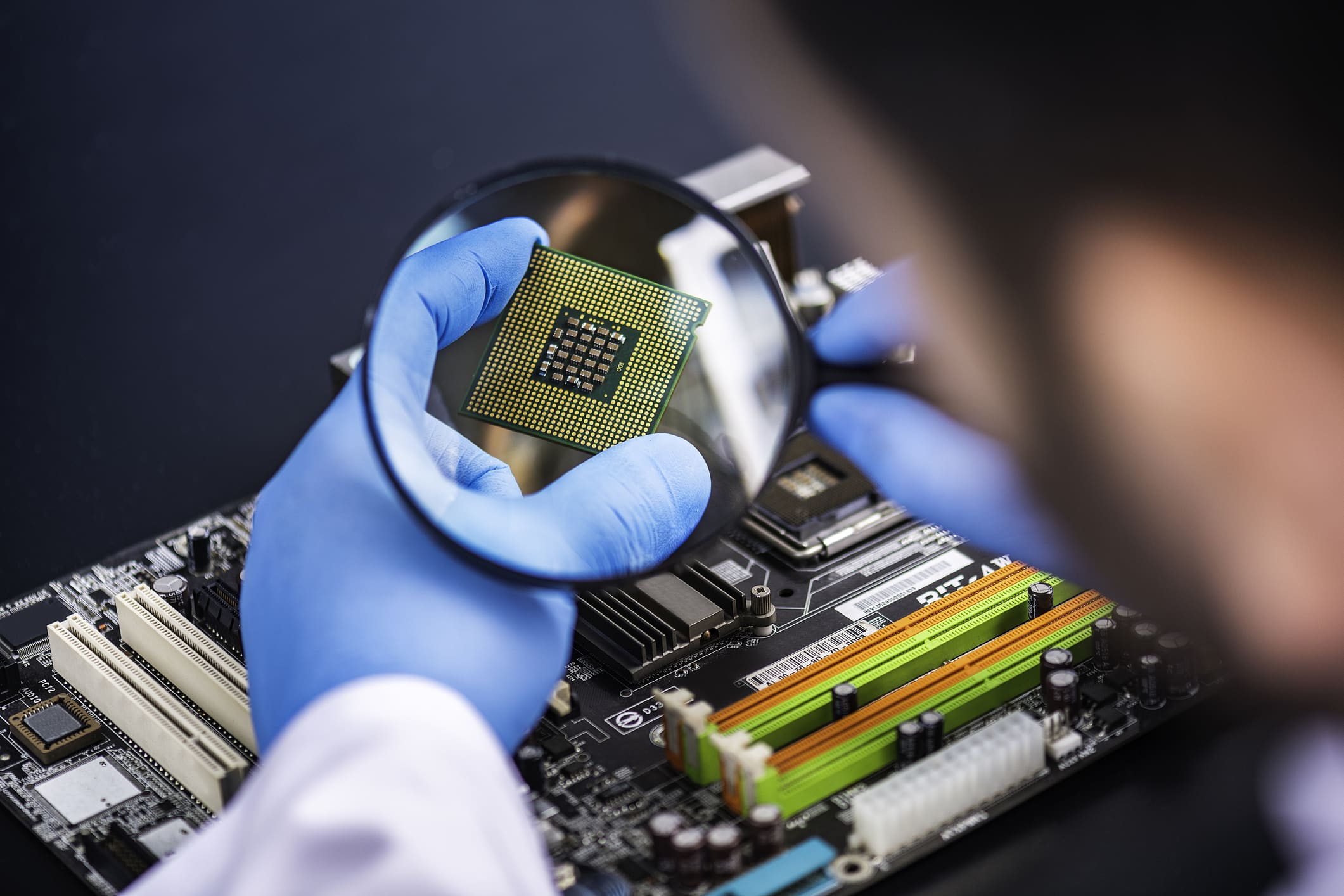

A technologist inspects a laptop chip.

Sefa Ozel | E+ | Getty Images

European Union lawmakers have laid out formidable plans to considerably ramp up manufacturing of semiconductors in the bloc and become a international leader in the business.

To do this, it’ll need a few of the key gamers from Asia and the U.S. to make investments closely in the continent, given the EU’s lack of know-how in essential areas like manufacturing, analysts stated.

On Tuesday, the European Commission, the manager arm of the EU, launched the European Chips Act — a multi-billion euro try to safe its provide chains, avert shortages of semiconductors in the long run, and promote funding into the business. It nonetheless requires approval from EU lawmakers to go.

Chips are essential for merchandise from fridges to automobiles and smartphones, however a international crunch has impacted industries throughout the board causing production standstills and shortages of products.

Semiconductors have become a national security issue for the U.S., and has even become a level of geopolitical tension between the U.S. and China. That conflict over semiconductors has led to sanctions on China’s biggest chipmaker SMIC and the world’s second-largest economy doubling down on efforts to boost self-sufficiency.

The EU is now attempting to mitigate a few of these dangers with its newest proposal.

“Faced with rising geopolitical tensions, quick development in demand, and the potential for additional disruptions in the availability chain, Europe should use its strengths and put in place efficient mechanisms to set up higher management positions and guarantee safety of provide inside the international industrial chain,” the European Commission stated.

Manufacturing problem

The EU Chips Act seems to be to plough 43 billion euros ($49 billion) of funding into the semiconductor business and help the bloc to become an “industrial leader” in the long run.

Specifically, the EU wants to enhance its market share of chip manufacturing to 20% by 2030, from 9% at present, and produce the “most refined and energy-efficient semiconductors in Europe.”

Part of its plan entails decreasing “extreme dependencies,” although the EU notes the need for partnerships with “like-minded companions.”

As it seems to be to become extra self-sufficient, the EU will nonetheless rely closely on the U.S. and in explicit, Asia. That’s due to the quirks of the semiconductor provide chain and the altering nature of the business.

Over the final 15 years or so, corporations have begun shifting to a fabless mannequin — the place they design chips however outsource the manufacturing to a foundry.

In the precise manufacturing of chips, Asian companies now dominate, led by Taiwan’s TSMC which has about a 50% market share in phrases of foundry income. South Korea’s Samsung is the subsequent largest, adopted by Taiwan’s UMC.

U.S. agency Intel, which was as soon as a key participant, has fallen behind in latest years. However, it’s now focusing on the foundry business and plans to make chips for different gamers. But its know-how nonetheless stays behind the likes of TSMC and Samsung which might take advantage of cutting-edge chips that go into the newest smartphones, for instance. Intel stated final yr it plans to spend $20 billion on two new chip plants in Arizona, in a bid to catch up.

The EU, nevertheless, has no corporations that may manufacture the newest chips.

“The major space the EU will need to companion is in bleeding edge wafer manufacturing. EU gamers at the moment are caught at 22nm and it’s unrealistic to assume that native EU gamers can catch up from 22nm (nanometers) to 2nm,” Peter Hanbury, a semiconductor analyst at analysis agency Bain, informed CNBC.

The nanometer quantity signifies the scale of the transistors on the chip. A small quantity means a larger variety of transistors can match, main to probably extra highly effective chips. The chip in Apple’s newest iPhone, for instance, is 5nm. These are thought-about the modern chips.

EU corporations may additionally depend on semiconductor design instruments from the U.S.

Boosting chip manufacturing to 20% market share is an “an especially tall order” for the EU, in accordance to Geoff Blaber, CEO of CCS Insights. “The give attention to manufacturing is the most important problem there,” Blaber informed CNBC.

Is the EU engaging sufficient?

As international locations and areas around the globe look to safe their semiconductor provides, there’s rising competitors to safe expertise and persuade corporations to make investments.

As a part of a $2 trillion financial stimulus package deal, U.S. President Joe Biden earmarked $50 billion for semiconductor manufacturing and research. A invoice referred to as the CHIPS for America Act can also be working its manner by means of the legislative course of.

Countries like Japan, South Korea and China are all boosting funding into semiconductors too.

“The major problem can be in attracting new gamers to the EU. Specifically, the EU should become a extra engaging location than different geographies,” Hanbury stated.

The EU has been attempting to woo modern chip producers. Intel is planning to construct a new chip fab in Europe, though a particular web site has not but been chosen. TSMC is in the early levels of assessing its personal manufacturing facility in Europe.

“The EU (or any geography) does not need to outspend the semiconductor gamers however quite to affect their spend to happen in their geography,” Hanbury stated.

EU strengths

Even although European companies are behind in the newest manufacturing know-how, the EU nonetheless has some key gamers in the semiconductor business.

One of an important is ASML, a Dutch agency that makes a machine used by the likes of TSMC, and is used to take advantage of cutting-edge chips. Apple suppliers STMicro and NXP are additionally each primarily based in Europe.

“[The] EU has a number of key property in the business,” Hanbury stated.

The EU’s focus may very well be on securing chip provide for sectors the place European companies have a massive presence such because the automotive business. Semiconductors that go into automobiles are sometimes much less superior and do not require the newest manufacturing know-how.

“Think about a few of these sectors the place we’re going to see the demand for the know-how in the approaching years and automotive is one massive alternative in Europe and I believe that is one thing I’d count on the EU to be specializing in,” Blaber stated.